What Are Payment Solutions?

Imagine a world where transactions were clunky, slow, and insecure. Not only would businesses struggle, but customers would also be frustrated. That's where payment solutions come in.

They are the backbone of the modern commerce experience, facilitating smooth, secure, and efficient money exchanges in a world that demands speed and reliability.

From in-store purchases to digital subscriptions, payment solutions enable every kind of business transaction.

At Valor, we understand that payments are not just about exchanging money – they're about ensuring a seamless, secure, and smart transaction every time. This is why we're constantly evolving to offer payment solutions that help businesses thrive

Types of Payment Solutions

Payment solutions come in various shapes and sizes, each designed to address different business needs. Below, we break down the different key types:

1. Point-of-Sale (POS) Terminals

POS terminals are the quiet achievers of the retail and hospitality industries. These systems are more than just cash registers – they play a vital role in managing sales, tracking inventory, and even generating reports that help businesses make data-driven decisions. Valor's POS devices are designed with one goal in mind: to make every transaction as simple as possible. Whether a quick coffee shop sale or a full-scale restaurant operation, our POS devices ensure that every tap, swipe, and dip goes smoothly.

2. Mobile Payment Solutions

With mobile payments on the rise, businesses are no longer limited by the traditional checkout counter. Mobile solutions turn smartphones and tablets into portable cash registers, allowing businesses to accept payments wherever they go. Whether running a food truck, managing a pop-up store, or offering on-the-go services, mobile payment solutions give you the flexibility to operate in a dynamic, fast-paced world. It's all about convenience, mobility, and accessibility for businesses and customers.

3. Online Payment Gateways

As e-commerce continues to boom, online payment gateways have become essential for businesses selling goods or services online. These gateways securely connect customers' payment information with the business's bank, ensuring each transaction is safe and quick. Whether it's a one-time purchase or a recurring subscription, online payment gateways ensure that the buying experience is seamless and secure. Valor's payment gateways are optimized for speed, security, and reliability, making online transactions as easy as clicking a button.

4. Contactless Payment Solutions

Contactless solutions – whether they're tap-to-pay cards or mobile wallets—are all about getting the customer in and out quickly. These solutions allow payments to be made with a simple tap or scan, reducing wait times and improving the customer experience. And because they use advanced encryption, contactless payments are just as secure as traditional card payments.

5. Integrated Payment Solutions

Juggling multiple payment systems can lead to confusion, errors, and inefficiency. Integrated payment solutions solve this problem by connecting your payment system with other business tools, such as accounting software, inventory management, and customer relationship management (CRM) platforms. This integration ensures that all your operations run smoothly and that your payment data is accurately recorded and easily accessible. With integrated solutions, you can streamline operations and focus on growing your business.

Why Do Businesses Need Reliable Payment Solutions?

Enhanced Customer Experience

Let's face it – customers expect convenience. Slow payment processing or outdated systems can lead to frustration, abandoned carts, and, ultimately, lost sales. A reliable payment solution ensures that every transaction is completed quickly, accurately, and with minimal friction, creating a smooth experience that keeps customers coming back.

Increased Security

Security is a top priority in the world of payment processing. Data breaches and fraud can severely damage a business's reputation and bottom line. That's why reliable fintech providers prioritize security, offering features such as encryption, tokenization, and fraud detection tools to protect sensitive customer data.

Simplified Operations

The right payment solution doesn't just process transactions – it also simplifies business operations. By automating tasks like sales tracking, reporting, and inventory management, payment solutions reduce administrative overhead and allow businesses to focus on what matters most: growing and serving their customers.

Greater Scalability

As businesses expand, so do their payment needs. A flexible and scalable payment solution grows with your company, offering additional features and functionality as your requirements evolve. Whether increasing your sales volume, expanding your product range, or entering new markets, a scalable payment solution can seamlessly accommodate those changes.

Cost Efficiency

Efficiency means savings. Smart payment solutions reduce errors, save time, and eliminate unnecessary costs. By automating processes and reducing manual intervention, businesses can lower operational costs and increase profitability.

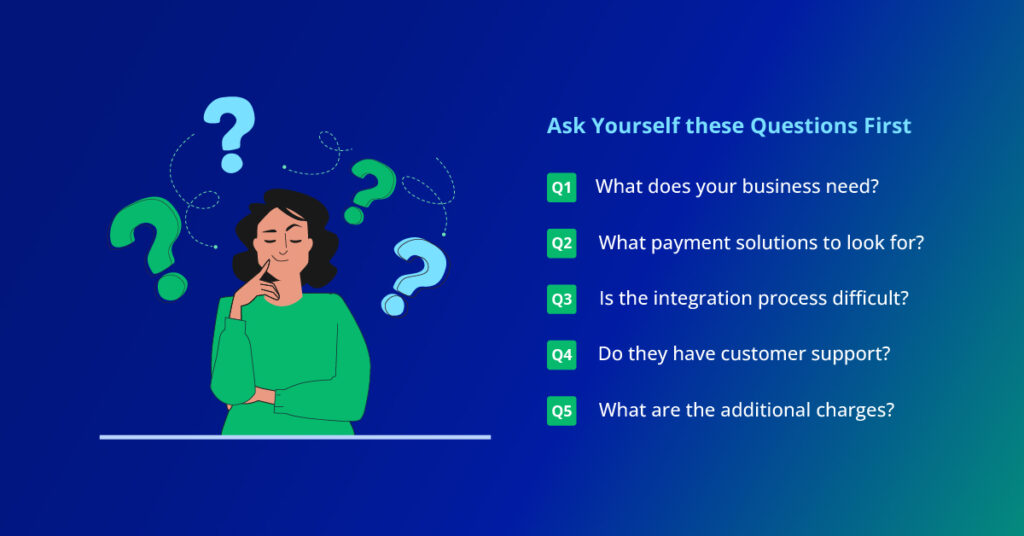

How to Choose the Right Payment Solution for Your Business

Choosing the right payment solution for your business is a critical decision that requires careful consideration of various factors. Here's how you can ensure you make the right choice:

Assess Your Business Needs

Start by identifying your specific business needs. Consider factors such as transaction volume, preferred payment methods (credit cards, digital wallets, etc.), and whether you require integration with other business systems (e.g., accounting software or CRM platforms). Understanding your business's unique needs will guide you toward the most suitable solution.

Ensure Security Compliance

Payment security is non-negotiable. Look for solutions that comply with industry standards, such as PCI DSS (Payment Card Industry Data Security Standard), and offer features like encryption and fraud detection. A secure payment solution protects both your business and your customers from potential threats.

Check Compatibility

Your payment solution must seamlessly integrate with your existing systems. Whether it's accounting software, inventory management, or customer relationship management tools, compatibility ensures smooth operations and avoids disruptions during implementation.

Review Customer Support

Even the most reliable payment provider can face occasional issues. Opt for a provider that offers 24/7 customer support to resolve problems quickly and minimize downtime. With excellent customer support, you can ensure that your payment systems always function at their best.

Compare Costs

When evaluating payment solutions, look beyond the initial setup costs. Consider transaction fees, maintenance costs, and any additional charges for extra features. Ensure the solution provides good value for money while meeting your business's requirements.